In quantum mechanics, the thought experiment of Schrödinger’s cat illustrates a system trapped in superposition: alive and dead until the box is opened and observed. The current AI investment craze may be exhibiting a similar paradox: is the bubble bursting, or is it still fully alive?

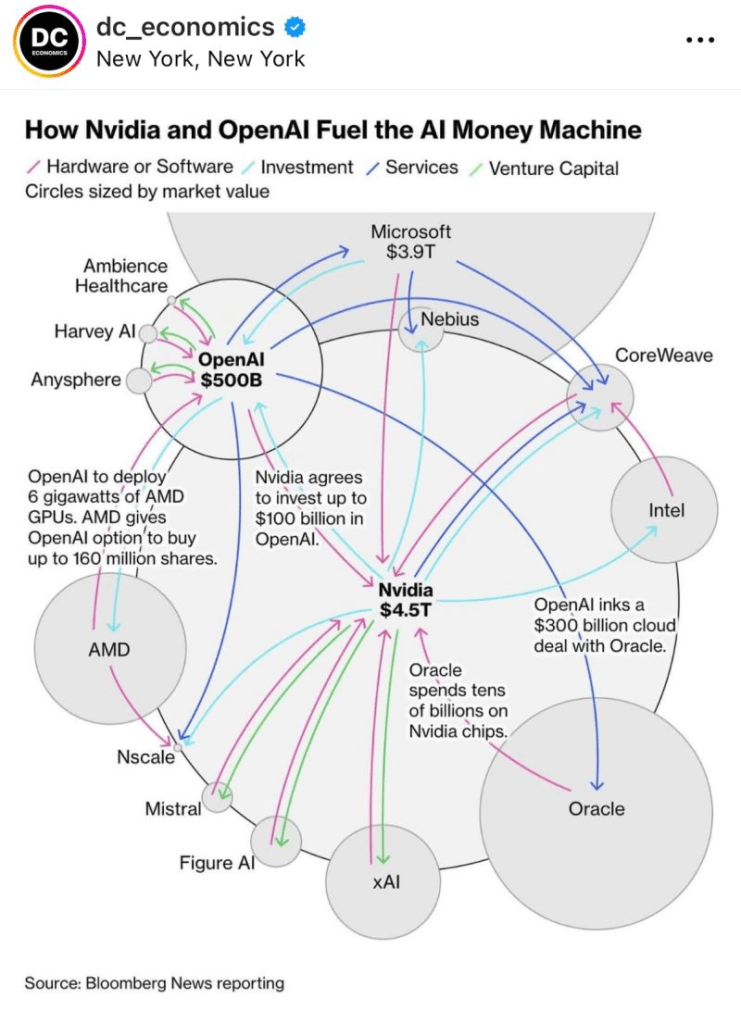

Not too long ago, we started witnessing the cyclic investment pattern of the big AI giants led by OpenAI and this prompted most analysts to question what could actually go wrong with this web of intertwined investment model.

On one hand, the case for a bursting bubble is built on the hallmarks of speculation with massive capital flows into AI infrastructure, soaring valuations for startups, and business models whose earnings are still uncertain and unknown. Some analysts warn that we are right on the edge of a correction. On the other hand, the chair of the Federal Reserve, Jerome Powell, has argued that this is not the dot-com bubble of the 1990s and that while he will not name any companies in particular, the companies have earnings and are not speculative. Similar arguments have been made, taking into consideration the fact that there is real money being invested in the AI economy. Some have indicated that even if the bubble was to burst, it leaves behind a trail of good (skills, infrastructure developed, industries created etc) and not all destruction; so maybe if it does bust, the risk was worth it?

Thus, the AI bubble exists in two states simultaneously, like the cat in the box, until one of the two realities is observed. Will the market “open the box” and collapse, or will the wave function resolve in favour of sustained growth? The answer matters for governments, investors and African economies alike.

For policymakers and practitioners in Africa, the key is to recognise this duality that demands that we treat AI investments as high risk but also high opportunity. Build safeguards such as measurable KPIs, realistic returns, and portfolio diversification while also positioning for the upside if the technology delivers its promise. The lesson here being – don’t bet everything, but don’t ignore the box either.

Leave a comment